Consumers would have received rebates of nearly $2 billion — in some cases as much as $300 a member — if the health-law cap on insurance profits and overhead had been in place in 2010, estimates a new study.

The paper, published Thursday by the Commonwealth Fund, makes no predictions about the rebates that insurers will be required to pay this year for the first time. But the study shows that insurers have been spending more on administrative costs than what the health law will allow, said Sara Collins, a Commonwealth Fund economist.

“The United States has insurer administrative costs that exceed those of private insurance companies in other industrialized countries,” she said. “It’s an indication that there is waste in the system that can be reduced.”

The 2010 Affordable Care Act allows insurers to devote no more than 15 to 20 percent of their revenue, in most cases, to overhead, profits, executive pay and the like. (This is the mirror of the requirement that they spend at least 80 to 85 percent of their revenue on medical care and quality improvements.)

Anything over the cap must be returned to the plan members and employers who pay the premiums. The rules for what’s known as the medical loss ratio took effect for 2011, with rebate checks of an undetermined amount scheduled to be sent out in August.

If the cap had been in place for 2010, nearly a fourth of privately insured consumers would have received rebates, the study said. More than half of those with individual coverage would have pocketed refunds. Rebates would typically have been $100 to $300 per member, the study said.

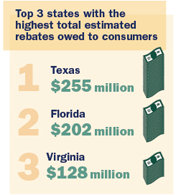

Texas insurance customers collectively would have received the most in rebates — $255 million — followed by those in Florida, who would have gotten $202 million. One fifth of nonprofit insurers would have owed rebates. Among for-profit plans, 70 percent would have been required to send rebate checks, said the study, which was conducted by Mark Hall of Wake Forest University and Michael McCue of Virginia Commonwealth University.

While 2011 insurer profits were substantial, some have suggested that moves by the industry to lower premiums last year will reduce rebates owed this year.

“Given the unpredictable nature of health care costs, it’s not surprising that some health care plans expect to pay rebates to consumers in some markets,” said Robert Zirkelbach, a spokesman for America’s Health Insurance Plans, an industry lobby. “But the amount — and to whom and in what markets — we’ll find out when they’re filed in June.”

Even though the study doesn’t predict how much in rebates will be paid, it gives an idea of the administrative dollars that would henceforth be devoted to reduced premiums, rebates or medical spending in order for the industry to comply with the law, Collins said.

“What you would hope to see over time is a reduction in the premium dollar that goes to profits and administrative costs and more of that premium dollar going to medical care,” she said.

AHIP’s Zirkelbach, on the other hand, said administrative spending ratios have declined. And he portrayed profits and administrative costs as minor factors in the big picture of health expense.

“This arbitrary cap on health care administrative costs does nothing to affect the real drivers of premium increases,” he said. “It doesn’t get at the underlying medical costs that are contributing to those increases.”