Brenda Powell had suffered a stroke and was in debilitating pain when she called the Social Security Administration last year to seek disability benefits.

The former Louisiana state office worker struggled at times to write her name or carry a glass of water. Powell, then 62, believed she could no longer work, and she was worried about how to pay for medical care with only a $433 monthly pension.

Although the Social Security Administration agreed that Powell’s condition limited the work she could do, the agency rejected her initial application for Supplemental Security Income. She had the choice to appeal that decision, which could take months or years to resolve, or take early retirement. The latter option would give her $302 a month now but might permanently reduce the full Social Security retirement payment she would be eligible for at age 66 and 10 months.

“I didn’t know what to do. These decisions are not easy,” said Powell, who lives in Alexandria, Louisiana, about 200 miles northwest of New Orleans. She decided to appeal the decision but take early retirement in the meantime.

“I had to have more money to pay my bills,” she said. “I had nothing left over for gas.”

Every year, tens of thousands of people who are disabled and unable to work consider taking early retirement benefits from Social Security. The underfunded federal disability system acknowledges that it is stymied by delays and dysfunction, even as over 1 million people await a decision on their benefits application.

The United States, which has one of the least generous disability programs among developed Western nations, denies most initial claims, leaving applicants to endure a lengthy appeals process.

At the same time, Social Security agents may neglect to explain the financial downside of taking retirement benefits too early, said attorneys who help patients file disability claims. The result is a growing population of vulnerable people who feel stuck between a proverbial rock and a hard place — to live with little money while they wait it out or agree to a significantly lower payment for the rest of their lives.

“They don’t have the luxury of waiting,” said Charles T. Hall, a disability attorney based in Raleigh, North Carolina. “The vast majority of people need the money now, and you can get early retirement benefits in two months or less.”

In a nation where more than a quarter of residents have a disability, Social Security Disability Insurance and Supplemental Security Income programs are intended to provide financial help to people who cannot work.

Retirement experts generally recommend senior citizens tap into their Social Security benefits as late as they can, to maximize the amount of money they receive from the federal government. For someone born after 1960, taking benefits at age 62 — the earliest age people are eligible — instead of 67 reduces each monthly payment by as much as 30% for the rest of a person’s life, said Richard Johnson, a senior fellow and the director of the Program on Retirement Policy at the Urban Institute, a nonprofit research organization.

Someone who applies for Supplemental Security Income, or early retirement, would get $914 a month if they can prove they are older than 65, blind, or have a disabling medical condition. Social Security Disability Insurance pays an average monthly benefit of $1,483 to those who suffered a disabling injury or illness and paid a federal tax that was deducted from their paychecks in the past.

Social Security agents will inform people of their ability to obtain early retirement benefits. But they might not explain the downsides, said Sam Byker, CEO and founder of Atticus, a California-based group that connects people seeking disability benefits with attorneys around the country. His organization found that among a sample of 765 clients ages 62-66 seeking Social Security Disability Insurance, 44% were already receiving early retirement.

Disability takes too long, and the decision about who gets approved can seem arbitrary, Byker said. “It cannot be counted on,” he said.

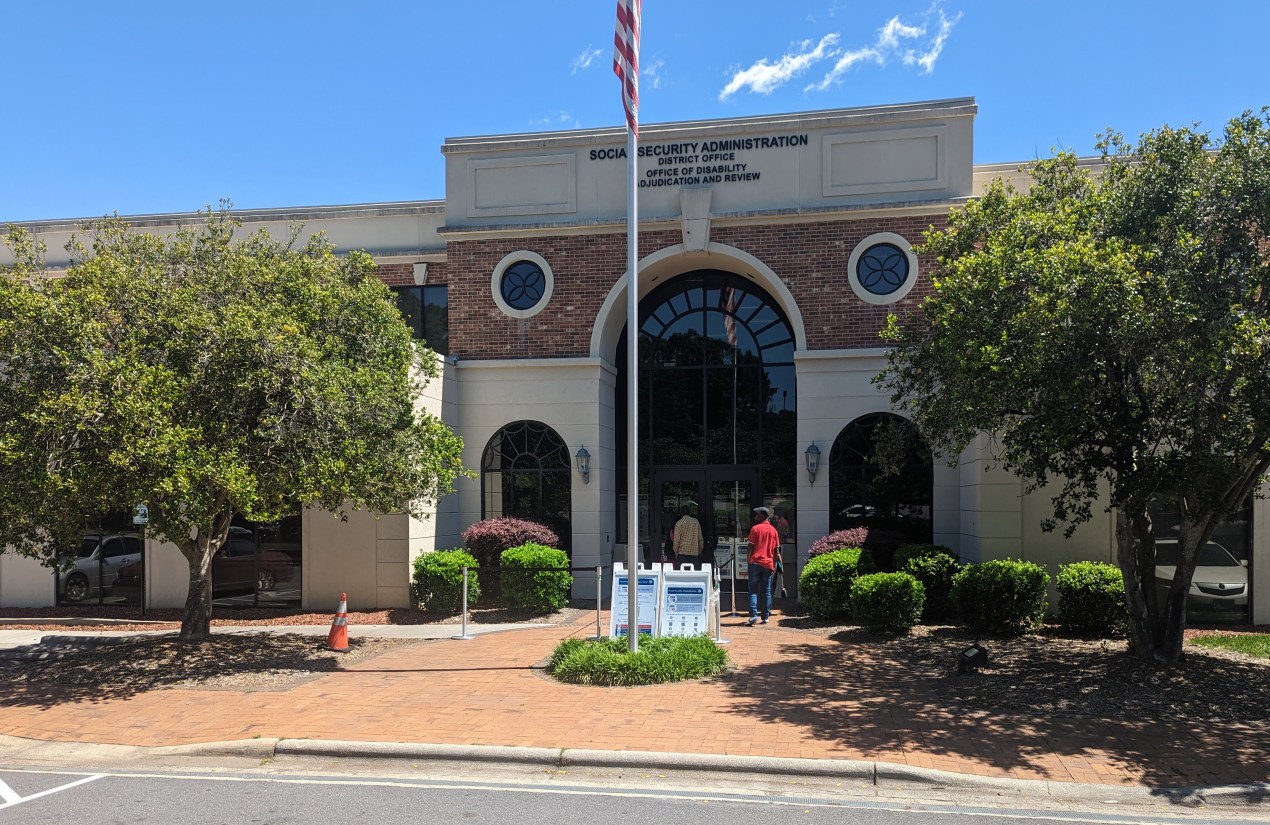

An initial decision on an application for disability benefits can take an average of over seven months, according to a March letter signed by more than 100 members of Congress.

Most callers to the Social Security Administration are unable to reach an agent, and people seeking local field office assistance with an application can wait at least a month for an appointment, the letter said.

Earlier this year, acting Social Security Commissioner Kilolo Kijakazi warned in a letter to congressional leaders that months-long delays in processing disability applications and phone assistance are likely to worsen in 2023, even as officials vow to improve service over time.

In a written statement, Social Security Administration spokesperson Darren Lutz acknowledged that wait times are “far too long,” citing inconsistent and insufficient funding, staffing shortages, and other challenges. The agency refused to make officials available for a phone call to discuss the issue in more detail.

Caught in the tangle of dysfunction are disabled people with little or no income, who often take early retirement because they are struggling to pay for basics like housing, food, and medicine. In some cases, people end up homeless or die waiting for their disability benefits, lawyers told KFF Health News.

The problems can hit especially hard in the South and Appalachia, since those regions tend to have an older workforce than most other parts of the country, more workers in manufacturing, and people with lower educational attainment who tend to rely more on disability benefits.

“It is a system in crisis,” said Ida Comerford, a managing partner for the Kenneth Hiller law firm, which handles disability cases in New York, Michigan, and Illinois. “This is not going to cut it. It is the worst I’ve ever seen it.”

The Social Security Administration said its workers are required to notify applicants about all the benefits they could receive and provide enough details for them to make an informed decision.

For someone who has no income and no ability to cover their expenses, it might make sense to take early retirement benefits, said Kurt Czarnowski, a former Social Security Administration regional communications director who now works as a retirement consultant.

If a person has a medical condition that suggests a shorter life span, Czarnowski said, it is probably wise to consider taking the smaller payments now instead of waiting for bigger checks later.

But there is a huge financial advantage for those who can wait, Czarnowski said.

People born after 1960 can collect full retirement benefits at age 67. In addition, each year they wait to collect Social Security between ages 67 and 70, their monthly check increases by 8%.

“Ultimately, it is a longevity decision,” Czarnowski said.

Hall also said he advises certain clients to take early retirement benefits while applying for disability. If the person wins their disability case, they can still collect full retirement benefits instead of the reduced amount, he said.

But Byker, of Atticus, said that strategy comes with risk. Most applicants need an attorney to help obtain disability through the lengthy appeals process. But lawyers are less likely to take a client who is already receiving early retirement benefits because that scenario significantly reduces the amount of money they can make on a case, he said.

More than 60% of applications for Supplemental Security Income are rejected, according to the Center on Budget and Policy Priorities, a nonprofit research organization. About two-thirds of applications for Social Security Disability Insurance are denied, the group says.

Six months after she applied, the Social Security Administration notified Powell in a February letter that her Supplemental Security Income claim had been denied. The letter said that while medical evidence shows her condition limits her ability to hold a job, she can do work in keeping with her skills as a finance assistant.

Lutz, the Social Security spokesperson, said in a written statement that privacy laws preclude the agency from answering questions about Powell’s case. Lutz said the agency uses a “stringent definition of disability.”

Powell has hired an attorney and filed an appeal, but she doesn’t know when the case will be resolved.

“I don’t want to say ‘poor, poor me,’” Powell said. “It has not been easy. I don’t wish this on nobody.”