A key goal of the Affordable Care Act is to help people get health insurance who may have not been able to pay for it before. But the most popular plans – those with low monthly premiums – also have high deductibles and copays. And that can leave medical care still out of reach for some.

Renee Mitchell of Stone Mountain, Georgia is one of those people. She previously put off a medical procedure because of the expense. But as the threat of losing part of her vision became a real possibility, she sought an eye specialist at Emory University, who told her she needed surgery to correct an earlier cataract procedure gone wrong.

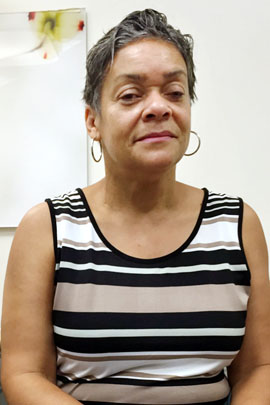

Renee Mitchell says even though she has health insurance she’ll have trouble paying for the eye surgery she needs to save her vision. (Photo by Jim Burress/WABE)

The eye surgery is not the scariest part, she said. Cost is: “further copays [and] more out-of-pocket expenses.”

Mitchell is generally pleased with her insurance — a silver-level Obamacare plan. It’s the most popular type of plan with consumers because of the benefits it provides for the money. But she still struggles to keep up with her part of the bills. She is not alone.

“One in four adults who were fully insured for the whole year still reported they went without some needed medical care because they couldn’t afford it,” said Lydia Mitts, a senior policy analyst with the health care advocacy group, Families USA.

Mitchell still owes more than $20,000 for several years of medical expenses, with more debt accruing in interest each month. “If not for having availability on my credit card, we’d probably be in the poorhouse,” Mitchell said.

If she undergoes that eye surgery, she said, she’ll owe another $4,000 – the deductible for the operation.

“It’s a very big burden,” Mitchell said.

A recent study released by Families USA shows that a lot of people with coverage like Mitchell’s feel a similar burden, and a poll from the Kaiser Family Foundation finds the same thing. The majority of people who buy insurance on state or federal exchanges pick silver-level plans, which often carry a lower monthly premium, but may still have a high annual deductible – $1,500 or more.

“Consumers are still struggling with unaffordable, out-of-pocket costs,” says Mitts.

Many people in that situation skip follow-up care and don’t fill prescriptions. Mitts said that only adds to long-term complications and costs.

But it doesn’t have to be that way, she said. Plans in some states, including Pennsylvania, Texas, Florida and Arizona, have recently done away with deductibles on some silver-level insurance plans. And for certain basic services, including doctors’ visits and generic prescriptions, other plans are requiring only a small copay.

Still, while copays, deductibles and co-insurance weigh heavy on Renee Mitchell’s mind, they’re not her only insurance concern. Her monthly premium is also getting more expensive. This year, she said, it jumped by about $100 a month.

Mitchell wants to be clear, though: She’s not looking for a handout.

“People seem to think that we just want something for nothing,” she said. “I worked a lot of years. I took an early retirement to take care of my family. It’s not my fault, so to speak, that I’m here.”

This story is part of a reporting partnership with WABE, NPR and Kaiser Health News.