This post has been updated to reflect the subject’s 2015 insurance coverage. Click here to read.

Jessica Bravo walks house-to-house in the piercing Southern California heat. Over and over, at doorsteps around Orange County, she asks the same question: “Are you insured?”

Getting an answer isn’t always easy. Doors slam in her face. She gets shooed from porches. And sometimes people cut her off mid-spiel.

Bravo is a paid health outreach worker for the Orange County Congregation Community Organization, a faith-based nonprofit. Her job is to inform people about getting health insurance under the nation’s landmark health law, the Affordable Care Act.

“A lot of people don’t know about this new law … this opportunity for health insurance,” said Bravo, a 19-year old Costa Mesa resident.

Until a few months ago, Bravo didn’t actually know coverage was an opportunity for her, as well.

She is an undocumented immigrant from Mexico. Most people without papers can’t get health insurance under the ACA. But last year, Bravo and her 21-year-old brother Daniel qualified for the Deferred Action for Childhood Arrivals (DACA) program – a 2012 initiative that grants temporary legal status to certain undocumented immigrants who were brought to the United States as children.

The law applies to people who came to the U.S. before turning 16, are in school or a high school graduate and are now under the age of 33.

They can obtain a work permit, a driver’s license, a Social Security number, a two-year reprieve from deportation and — as Bravo now realizes — the opportunity to get health insurance through Medi-Cal, California’s insurance program for poor and disabled people. Only a few other states offer similar options.

Now studying politics and ethnic studies full time at Golden West College in Huntington Beach, Bravo can’t work as much as she used to. Her monthly income of $960 likely would make her eligible for Medi-Cal.

Figuring out her options under the law was especially difficult for Bravo, whose family is of “mixed status.” That is, some have federal authorization to be in this country and others don’t. While anyone can buy insurance privately, people without legal status are not allowed to buy insurance on the exchange or participate in most government program such as Medicare, non-emergency Medicaid or the Children’s Health Insurance Program.

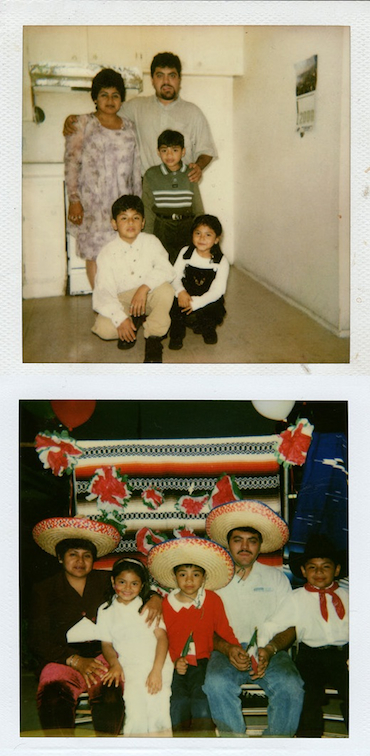

Her parents are in the country without permission, as is her older brother Luis, 22, who did not qualify for DACA. Her other brother Daniel, 21, was granted DACA status and qualifies for the same benefits she does. And her brother Alex, 11, is a U.S.-born citizen, covered through California Kids – a nonprofit health insurance plan.

‘Stuck In The Middle’

The family’s history is complicated. After several failed visa attempts, her father Enrique Bravo crossed the border illegally in 1996. His wife, Virginia, tried to cross by hiding in a car but was caught by border patrol agents. Desperate to join her husband, she tried again and made it across six months later. Three-year-old Jessica and her older brothers later crossed with legal-resident relatives in a car.

“I’m 100 percent Mexican…but all my memories growing up are from the United States,” said Jessica. “It’s like I’m stuck in the middle…I’m neither from here or there.”

As the older children grew up, getting health care proved dicey. The family tried to stay below the radar. This meant visiting the doctor only when absolutely necessary — and always paying cash.

They were, like many immigrants, fearful of exposing the family’s unauthorized status and risking deportation, for themselves and their children.

Eventually Enrique, an electrician, found a job that offered health insurance, and for several years the family was insured. But he got laid off in 2006. From then on, they were forced to rely on local community clinics that provide care on a sliding pay scale.

“I remember my parents telling me that I was no longer going to be insured under their plan,” said Jessica. “I just tried to eat healthy.”

Her biggest concern now, she says, is that one of the others will get sick and the family won’t be able to pay for care.

“Even though that fear is gone for me, it’s still very real for my family,” said Bravo, who is in the process of renewing her DACA status for another two years.

“It’s difficult to grasp that I have this privilege, yet my parents who worked twice as hard, don’t have anything.”

Recent events have compounded the family’s worries.

Jessica’s brother Luis was recently detained by agents from Immigration and Customs Enforcement as a result of a tip arising from a prior conviction for driving under the influence. It’s unclear what will happen until the immigration court hears his case and decides whether he can remain in the U.S.

“It all seems like a dream…it happened so fast,” said Jessica. “We’re doing everything we can to stop his deportation.”

One Fall Can Change Everything

Weeks ago, Jessica’s mother Virginia stumbled and fell to the ground in front of their Costa Mesa apartment, spilling the milk she’d just bought. The 48-year-old former hairstylist hurt her arm, but despite feeling a sharp pain she won’t be visiting the emergency room.

“We can’t afford it,” Virginia Bravo said. The mother of four has been unemployed for over a year and is more concerned about stocking the empty refrigerator than seeking treatment.

She knows all too well that without insurance an unexpected injury could leave them bankrupt.

Last year, Enrique had to be rushed to the emergency room. He woke up in the middle of the night with extreme paranoia, unable to catch his breath, and feeling numb.

He was having a panic attack. The bill for the two-hour hospital stay was about $6,000. Already struggling financially, the family had to find a way to pay cash.

“At first I refused to go to the hospital,” he said. “I knew it would be expensive.”

The 44-year-old says he struggles to earn at least $2,250 each month as a self-employed electrician – the exact amount he needs to pay rent.

Any extra money is used to buy food and pay bills. Saving for an emergency is impossible, the family members said.

“We’re poor, but rich in health and family unity,” Virginia Bravo said.

Living in a mixed-status family has been challenging, but it has also brought them closer, she said. The whole family has been involved in campaigning for immigration reform and hopes the ACA will eventually include coverage for undocumented immigrants.

“People don’t know what we had to go through to get here,” said Virginia. “We made it across … we’re the lucky ones.”

“We don’t want anything for free,” she said. “If we had an opportunity to buy health insurance, we would find a way to pay for it.”

Updates

January 2015

Busy with work and final exams, Jessica Bravo put her Medi-Cal application on hold for a few months.

“I haven’t had time to figure it out, she said in December 2014.

The Medi-Cal process was confusing for Bravo. “I was trying to do it on my own, but stopped when they asked for financial information,” she said.

An enrollment counselor told her she needed to prove her income. “I finally gathered my paperwork and I’m hoping to go see her during one of my days off.”

She’s relieved she hasn’t had any health problems. Her only concern is getting new glasses. “They broke and I can’t afford a new pair right now,” she said. “I’m waiting to see what kind of coverage I get.”

But before she could move forward with her Medi-Cal application, Bravo needed to renew her permit to stay in the U.S. under the deferred action program for children who came to the country illegally with their parents.

“That’s my biggest priority right now…to make sure I get my renewal,” she said. “Everything else comes after that.”

As for Bravo’s brother, Daniel, he has insurance through his job as a health care outreach worker, but he hasn’t used it yet.

“So far, I haven’t been sick,” he said. “But I’ve been wanting to get a check up.”

July 2015

Jessica Bravo finally got around to submitting her Medi-Cal application and received her card, and new health coverage, a few weeks ago. “I was assigned Alta-Med, but I want to switch to Kaiser,” she said.

Bravo says the card couldn’t have come at a better time. “I think I need a physical …I want to get preventive care,” she said.

Bravo had been getting by with her mom’s home remedies whenever she caught a cold. “There was a point where I wanted to go to the doctor, but stuck it out because I didn’t have insurance yet,” she said.

Bravo has a history of ovarian cysts and has been experiencing pain in her lower abdomen. “I want to make sure everything is OK before I start freaking myself out,” she said.

This summer, she’s taking it easy. Bravo is only enrolled in one class and works at a retail store part-time. “I know my stress levels can also play a role,” she said.

Bravo said she will be back in school full-time in the fall and wants to make sure she’s up for it. “That’s one of my priorities right now … making sure that my personal health is OK before I start taking on more stuff,” she said.