Medical costs aren’t just breaking government budgets. The price of commercial health insurance has risen five times faster than family incomes since 2003 even as the financial security it offers has shrunk, says a new Commonwealth Fund report that underscores how medicine is consuming bigger and bigger parts of the private economy.

“Wherever you live in the United States, health insurance is expensive, and for many middle- as well as low-income families it is becoming ever less affordable,” said Cathy Schoen, Commonwealth Fund senior vice president. “Workers are paying more for less financial protection when they get sick.”

The average total cost of family health insurance — employer and employees’ shares — hit $15,022 last year, up 62 percent since 2003, while the median family income rose only 11 percent during the same period, the report said. If that trend continues, premiums for family coverage will come close to $25,000 by 2020.

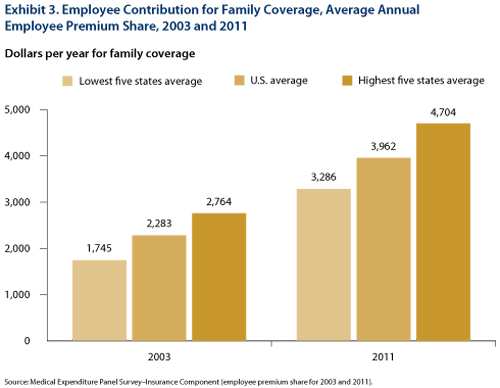

And because employers are passing a bigger share of costs to workers, the overall premium increase doesn’t reflect the full growth of the consumer burden. The average employee paid $3,962 in premiums for a family plan in 2011 — up 74 percent from 2003. Deductibles more than doubled in the same period, meaning out-of-pocket costs soared, too.

In 2003 about half of workers had to pay an average deductible of about $1,000 for a family plan, the study said. In 2011, 78 percent of workers had deductibles averaging more than $2,000. Average deductibles were higher at small employers — $3,329 for a family plan in 2011.

Soaring premium costs for employers have often translated into skimpy cash raises for workers, leaving them little wherewithal to absorb higher out-of-pocket expenses.

In most states average total health insurance premiums are now 20 percent or more of median family incomes, the report found. In some low-income states — West Virginia, New Mexico, South Carolina and Texas — the portion exceeded 25 percent.

Overall health cost increases have decelerated in recent years with the economic slowdown and as the Affordable Care Act, which contains measures to restrain expenses, comes closer to implementation. But that doesn’t mean employers won’t continue to shift medical costs to workers. “The question is whether consumers will benefit from these trends” of smaller cost increases, said Commonwealth Fund President Karen Davis.