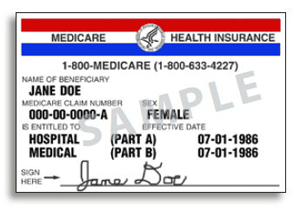

Lawmakers are looking for ways to tackle the growth of Medicare spending, which the Congressional Budget Office estimates will account for 24 percent of the federal budget by 2037. But some strategies to cut program costs could leave millions of beneficiaries without coverage.

A study from the Rand Corporation, a nonprofit research organization, compared the impact of three

A study from the Rand Corporation, a nonprofit research organization, compared the impact of three proposals that have been discussed by Congress or the White House to curb the costs of the government health care program for seniors and the disabled. The study is published in the May issue of Health Affairs.

Here are the three policy changes the study modeled.

Means testing Part A: Medicare Part A includes coverage of care in hospitals and nursing homes, and unlike Part B (which covers doctor visits, labs and equipment), the Part A premium is the same no matter how much a beneficiary earns. The idea of making wealthier seniors pay more for Part A has been around for a long time: It was suggested by the bipartisan Kerrey-Danforth commission back in the mid-1990s.

Premium support: Premium support would give seniors a set amount of money to purchase a private or Medicare-like health insurance plan. It’s a proposal similar to the one championed by House Budget Committee Chairman Paul Ryan (R-Wis.).

Raising the eligibility age: If Medicare mirrored Social Security, the eligibility age would be 67. This proposal has been floated by both parties and has stoked heated debate. Medicare’s age requirement has not changed since the program’s inception in 1965, though life expectancy has increased by eight years in that time.

“The magnitude of savings can vary quite substantially,” said author Christine Eibner, a senior economist at RAND, about the results of the comparative study.

The researchers found that premium support and raising the eligibility age were the most effective changes to curb costs. Increasing the eligibility age, for example, reduced federal spending by 7.2 percent through 2036, compared to 2.4 percent if a premium for Part A was added. And the premium support plan resulted in the most savings after 2019 of all three options.

The savings from raising the eligibility age in the RAND study was different from earlier Congressional Budget Office estimates because the Rand authors modeled the outcome with the idea of raising the age in 2014. The government office instead assumed the age would gradually be raised and not be in full effect until 2027.

But all three scenarios had downsides and the two scenarios that produced the greatest potential savings also produced the greatest possible burden for Medicare enrollees both financially and in terms of access to health care.

In the means-tested strategy, somewhere between 2 and 20 percent of eligible beneficiaries may choose not to enroll in Medicare Part A, researchers found. For the premium support plan, the authors estimate 13 percent of seniors would forgo coverage. And raising the eligibility age to 67 also would reduce enrollment by approximately 13 percent, according to the study.