Latest KFF Health News Stories

Middle-Class Earners Weigh Love And Money To Curb Obamacare Premiums

Ineligible for subsidies, a Tennessee woman quit her job to get an affordable health care premium. Conventional steps — such as maxing out your 401(k) contribution each year — may also do the job, financial planners say.

Congress Isn’t Really Done With Health Care — Just Look At What’s In The Tax Bills

Even though congressional Republicans set aside their Obamacare repeal-and-replace efforts this year, here are five major health policy changes that could become law as part of the pending House and Senate proposals.

Desperate For Coverage: Are Short-Term Plans Better Than None At All?

As stopgap health plans gain attention as possible alternatives to Obamacare, consumers are advised to read the fine print.

Obamacare: comprar seguro es más complicado que nunca. Aquí, algunas tretas

Es esencial que conozca sus opciones en base a los ingresos y al tamaño de su familia. Aquí, algunas respuestas clave para entender el mercado de seguros.

Obamacare Shopping Is Trickier Than Ever. Here’s A Cheat Sheet.

This year, more than ever, it is important to know your options.

Big Premium Hike? Blame It On The Kids

Premiums are rising for many reasons next year, and one is that insurers are charging a lot more for teenagers.

Rising Health Insurance Costs Frighten Some Early Retirees

Higher premiums loom for Americans in their late 50s and early 60s who are still too young for Medicare and don’t qualify for subsidies under Obamacare.

Obamacare: 5 nuevas cosas que debes saber

El período abierto de inscripción para las personas que compran su propio seguro de salud ya está en marcha, y termina el 15 de diciembre de 2017. Estos son cinco factores para tener en cuenta.

Past-Due Premiums, Missing Tax Forms May Hamstring Marketplace Customers

People hoping to get federal subsidized marketplace coverage may need to make sure their 2017 premiums are paid and that they filed all the correct documents with their 2016 taxes.

5 Things To Know About ACA At Year 5

This year’s Obamacare open enrollment will be marked by a number of changes. KHN helps you navigate them.

Anthem Eases Up On Premium Hikes After State Scrutiny

After regulators questioned Anthem’s forecast for medical costs, the company agreed to reduce rate hikes on its individual and small-business health plans next year, saving customers an estimated $114 million.

Facebook Live: Things To Know About Trump’s Directive On Health Insurance

In this Facebook Live, KHN’s Julie Appleby answers questions about President Donald Trump’s executive order regarding insurance.

Trump’s Order Advances GOP Go-To Ideas To Broaden Insurance Choices, Curb Costs

But the approaches are not new and critics worry that these changes will leave some consumers with skimpier plans that expose them to high medical bills.

Overlooked By ACA: Many People Paying Full Price For Insurance ‘Getting Slammed’

For several million consumers who buy their own insurance but earn too much to qualify for subsidies, the ever-growing price of premiums takes a big toll.

Despite Boost In Social Security, Rising Medicare Part B Costs Leave Seniors In Bind

With higher premiums on tap for many Medicare enrollees, here’s help figuring out the particulars of the Part B puzzle and how it affects you.

Adultos mayores tendrán ajustes del Seguro Social, pero pagarán más por el Medicare

Millones de adultos mayores pronto serán notificados (si no lo han sido ya) que las primas del Medicare para servicios médicos están aumentando y podrían consumir el ajuste de costo de vida que recibirán el próximo año del Seguro Social.

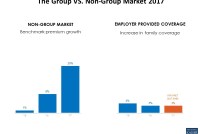

In Stark Contrast To ACA Plans, Premiums For Job-Based Coverage Show Modest Rise

Employers report the sixth consecutive year of small increases, but workers at small firms feel the biggest pinch, according to the Kaiser Family Foundation survey.

5 ideas controversiales para arreglar el mercado de seguros individual

Desde modificar la edad de ingreso al Medicare, hasta tener un Medicaid “a la carta”, estas ideas están sonando y generando polémica en los pasillos del Congreso.

5 Outside-The-Box Ideas For Fixing The Individual Insurance Market

As lawmakers look for ways to stabilize the health law marketplaces, a number of ideas — such as expanding who can “buy in” to Medicare and Medicaid or pushing young adults off their parents’ plans into the marketplaces — might come into play.

Why One Insurer’s Collapse Could Whack Insurers, Policyholders Across the Country

Little-known rules require all health insurance companies to help pay claims when any one of them fails. Penn Treaty failed big — and insurers around the country are likely to pass those costs onto policyholders.