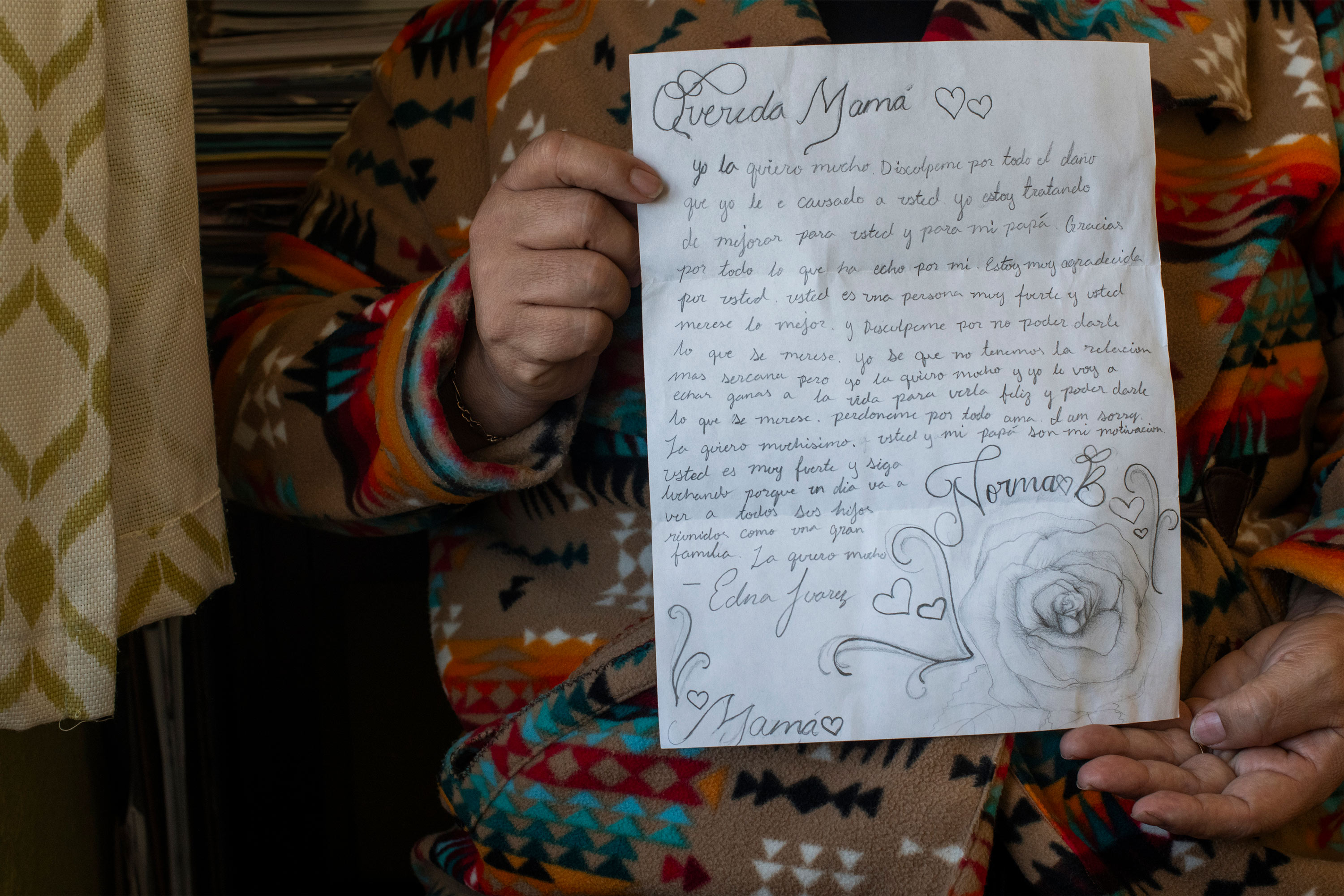

DENVER — In February, Norma Brambila’s teenage daughter wrote her a letter she now carries in her purse. It is a drawing of a rose, and a note encouraging Brambila to “keep fighting” her sickness and reminding her she’d someday join her family in heaven.

Brambila, a community organizer who emigrated from Mexico a quarter-century ago, had only a sinus infection, but her children had never seen her so ill. “I was in bed for four days,” she said.

Lacking insurance, Brambila had avoided seeking care, hoping garlic and cinnamon would do the trick. But when she felt she could no longer breathe, she went to an emergency room. The $365 bill — enough to cover a week of groceries for her family — was more than she could afford, pushing her into debt. It also affected another decision she’d been weighing: whether to go to Mexico for surgery to remove the growth in her abdomen that she said is as big as a papaya.

Brambila lives in a southwestern Denver neighborhood called Westwood, a largely Hispanic, low-income community where many residents are immigrants. Westwood is also in a ZIP code, 80219, with some of the highest levels of medical debt in Colorado.

More than 1 in 5 adults there have historically had unpaid medical bills on their credit reports, more in line with West Virginia than the rest of Colorado, according to 2022 credit data analyzed by the nonprofit Urban Institute.

The area’s struggles reflect a paradox about Colorado. The state’s overall medical debt burden is lower than most. But racial and ethnic disparities are wider.

The gap between the debt burden in ZIP codes where residents are primarily Hispanic and/or non-white and ZIP codes that are primarily non-Hispanic white is twice what it is nationally. (Hispanics can be of any race or combination of races.)

Medical debt in Colorado is also concentrated in ZIP codes with relatively high shares of immigrants, many of whom are from Mexico. The Urban Institute found that 19% of adults in these places had medical debt on their credit reports, compared with 11% in communities with fewer immigrants.

Nationwide, about 100 million people have some form of health care debt, according to a KFF Health News-NPR investigation. This includes not only unpaid bills that end up in collections, but also those being paid off through installment plans, credit cards, or other loans.

Racial and ethnic gaps in medical debt exist nearly everywhere, data shows. But Colorado’s divide — on par with South Carolina’s, according to the Urban Institute data — exists even though the state has some of the most extensive medical debt protections in the country.

The gap threatens to deepen long-standing inequalities, say patient and consumer advocates. And it underscores the need for more action to address medical debt.

“It exacerbates racial wealth gaps,” said Berneta Haynes, a senior attorney with the nonprofit National Consumer Law Center who co-authored a report on medical debt and racial disparities. Haynes said too many Colorado residents, especially residents of color, are still caught in a vicious cycle in which they forgo medical care to avoid bills, leading to worse health and more debt.

Brambila said she has seen this cycle all too often around Westwood in her work as a community organizer. “I really would love to help people to pay their medical bills,” she said.

Health or Debt?

Roxana Burciaga, who grew up in Westwood and works at Mi Casa Resource Center there, said she hears questions at least once a week about how to pay for medical care.

Medical debt is a “big, big, big topic in our community,” she said. People don’t understand what their insurance actually covers or can’t get appointments for preventive care that suit their work schedules, she said.

Many, like Brambila, skip preventive care to avoid the bills and end up in the emergency room.

Doctors and nurses say they see the strains, as well.

Amber Koch-Laking, a family physician at Denver Health’s Westwood Family Health Center, part of the city’s public health system, said finances often come up in conversations with patients. Many patients try to get telehealth appointments to avoid the cost of going in person.

Adding to the crunch is Medicaid "unwinding", the process of states reexamining post-pandemic eligibility for health coverage for low-income people, Koch-Laking said. “They say, ‘Oh, I'm losing my Medicaid in three weeks, can you take care of these seven things without a visit?’ Or like, ‘Can we just do it over the portal, because I can't afford it?’”

Looking for the Right Fix

Colorado has taken steps to protect patients from medical debt, including expanding Medicaid coverage through the 2010 Affordable Care Act. More recently, state leaders required hospitals to expand financial assistance for low-income patients and barred all medical debts from consumers’ credit reports.

But the complexities of many assistance programs remain a major barrier for immigrants and others with limited English, said Julissa Soto, a Denver-based health equity consultant focused on Latino Coloradans.

Many patients, for example, may not know they can seek help with medical bills from the state or community nonprofits.

“The health care system is a puzzle. You better learn how to play with puzzles,” said Soto, who said she was sent to collections for medical bills when she first immigrated to the U.S. from Mexico. “Many hospitals also have funding to help out with your debt. You just have to get to the right person, because it seems that nobody wants to let us know that those programs exist.”

She said simplifying bills would go a long way to helping many patients.

Several states, including Oregon, Maryland, and Illinois, have tried to make it easier for people to access hospital financial aid by requiring hospitals to proactively screen patients.

Patient and consumer advocates say Colorado could also further restrict aggressive debt collection, such as lawsuits, which remain common in the state.

New York, for example, banned wage garnishment after finding that the practice disproportionately affected low-income communities. Research there also showed that medical debt burden was falling about twice as hard on communities of color as it was on non-Hispanic white communities.

Elisabeth Benjamin, a lawyer with the Community Service Society of New York, said hospitals were garnishing the wages of people working at Walmart and Taco Bell.

Maryland enacted limits on debt collection lawsuits after advocates found that patients living in predominantly minority neighborhoods were being disproportionately targeted. Even in wealthy counties, “the pockets that are being pursued are majority Latino neighborhoods,” said Marceline White, executive director of the advocacy group Economic Action Maryland.

White's group helped pass a law requiring hospitals to pay back low-income patients and avoid the scenario she was seeing, in which hospitals were “suing patients who should have gotten free care.”

Exacting a Heavy Toll

In Colorado, lawmakers are considering a measure to improve patients’ access to financial aid: a modification to the state’s Hospital Discounted Care program that would make hospitals presumptive eligibility sites for Medicaid.

Meanwhile, some consumer advocates say existing protections aren’t working well enough.

State data shows patients who received financial assistance were primarily white. And, though it’s unclear why, 42% of patients who may have been eligible were not fully screened by hospitals for financial assistance.

“What is clear is that a lot of people are not making it through,” said Bethany Pray, deputy director of the Colorado Center on Law and Policy, a Denver-based legal aid group that pushed for the discounted care legislation.

Within the state’s immigrant communities, medical debt — and the fear of debt — continues to take a heavy toll.

“What we’ve heard from our constituents is that medical debt sometimes is the difference between them being housed and them being unhoused,” said Denver City Council member Shontel Lewis. Her district includes the 80216 ZIP code, another place north of the city center that is saddled with widespread medical debt.

Paola Becerra is an immigrant living in the U.S. without legal permission who was pregnant when she was bused to Denver from a Texas shelter a few months ago.

She said she has skipped prenatal care visits because she couldn’t afford the $50 copays. She has emergency health coverage through Medicaid, but it doesn’t cover preventive visits, and she has already racked up about $1,600 in bills.

“I didn't know that I was going to arrive pregnant,” said Becerra, who thought she could no longer conceive when she left Colombia. “You have to give up your health. Either I pay the rent, or I pay the hospital.”

For Rocio Leal, a community organizer in Boulder, medical debt has become a defining feature of her life.

Despite the health insurance she had through her job, Leal ended up with high-interest payday loans to pay for healthy births, wage garnishment, prenatal appointments she missed to save money, and a “ruined” credit score, which limited her housing options.

Leal recalled times she thought they’d be evicted and other times the electricity was cut off. “It's not like we're avoiding and don't want to pay. It's just sometimes we don't have an option to pay,” she said.

Leal said the worst times are behind her now. She’s in a home she loves, where neighbors bring cakes over to thank her son for shoveling the snow off their driveway.

Her children are doing well. One daughter got a perfect GPA for the second semester in a row. Another is playing violin in the school orchestra. Her third daughter attends art club. And her son was recently accepted to college for biomedical engineering. They are covered by Medicaid, which has removed the uncertainty around big medical bills.

But medical debt still haunts Leal, who has Type 2 diabetes.

When she was referred to Boulder Medical Center to get her eyes checked after the diabetes diagnosis, she said she was told there was a red flag by her name. The last time she’d interacted with the medical center was about a dozen years earlier, when she’d been unable to pay pediatrician bills.

“I was in the process of moving and then my wages were garnished,” she recalled. “I just was like, ‘What else do I owe?’”

Heart pounding, she hung up the phone.

KFF Health News senior correspondent Noam N. Levey contributed to this report.