Leaders from some of the nation’s top consumer and seniors advocacy groups today urged President Barack Obama not to weaken a key consumer provision of his signature health care overhaul law.

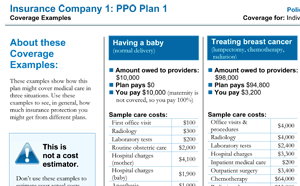

The provision requires health insurers and employers to use standardized, easy-to-understand information documents to describe health plan benefits and costs. These forms would explain how much each plan pays on average for three common medical conditions and include a glossary of insurance terms.

The provision requires health insurers and employers to use standardized, easy-to-understand information documents to describe health plan benefits and costs. These forms would explain how much each plan pays on average for three common medical conditions and include a glossary of insurance terms.

“The summary of benefits and coverage [document] is a vital first step in making consumers better informed and able to make the proper decisions for themselves,” said Stephen Finan, senior director for policy for the American Cancer Society Cancer Action Network, one of the signers of the letter to the president. In some states, information about providers and other policy details are not disclosed until after a consumer applies for coverage, he said. Shoppers today, he explained, can get better information about buying a new washing machine than they can about a health insurance policy.

“You pay first and learn later,” he said.

The letter was signed by the chief executive officers of the American Cancer Society, American Heart Association, American Diabetes Association, Consumers Union and AARP, which has 37 million members age 50 and older.

According to the law, the forms are supposed to be distributed starting March 23, but the groups are worried about the administration’s long delay in setting final regulations that spell out how to use the forms. The draft regulations that include the proposed forms were issued in the summer and the administration has been reviewing comments on those. “As the Administration approaches its final decisions on the [summary of benefits and coverage] rule, we strongly encourage you to adhere to the letter of and intent of the Affordable Care Act,” the CEOs wrote.

Although they concede that there’s probably not enough time to meet the March deadline, they would like the forms available for the fall open enrollment season for group insurance plans. They also urged that the forms be used in both group and individual insurance plan markets, , as the law and proposed rules require, and that they include premium price information as well as several coverage examples.

In comments on the proposed rules, insurance and business trade associations explained how some of these features would be difficult to implement now and asked for further delays.

The new forms were written by a working group of the National Association of Insurance Commissioners, which included industry and consumer representatives along with state insurance regulators and were later incorporated into the administration’s proposed rules.

Erin Shields, a spokeswoman for the U. S. Department Health and Human Services declined to say whether the final rules will favor the positions taken by industry or consumer groups.

“As always, we appreciate this and all feedback and value a constructive dialogue on this important, new consumer protection,” she said.