One of the biggest problems governors face during a recession is this: When the economy is going down, Medicaid enrollment is going up. So states have more people in their Medicaid program, but less tax revenue to pay for them. It is what economists call counter-cyclical.

Washington is sensitive to the problem. During the most recent recession, as part of the Recovery Act, Congress voted to increase the federal government’s share of Medicaid costs, known as the Federal Medical Assistance Percentage (FMAP). Under FMAP, states receive a set “match” amount, and depending on the state, that amount is normally 50 to 76 percent of the Medicaid costs. Because of the stimulus funding, that range increased to 62 to 85 percent of costs.

A Kaiser Family Foundation analysis found that while the extra funds “provided critical fiscal relief for all states, the funds were not targeted to states with the highest unemployment rates. … The data used to calculate the FMAP are lagged and therefore may not accurately reflect a state’s economic distress.” (KHN is an editorially-independent program of the foundation.)

Enter the Government Accountability Office. Congress asked the GAO to figure out the best way to decide how much extra Medicaid money states should get during hard times, and when they would get it.

In March, GAO came up with a formula, and this week it examined how it would have worked during the recession. The new formula would be based on a state’s particular unemployment and taxable income levels compared against the national average.

“In the Recovery Act, every state got a 6.2 percent increase in their federal funding across the board,” says Carolyn Yocom, one of the directors for the GAO report. She says this new proposal would eliminate generic increases, also called bump ups, and instead would look at changes to the state’s unemployment rate and total wages/salaries.

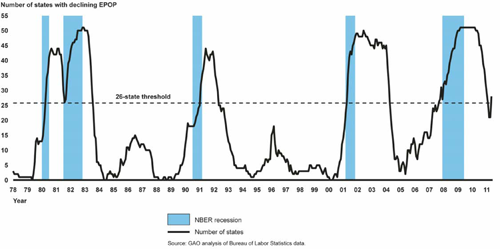

“Under our proposal the amount of assistance a state got varies based on those two factors and there are no automatic bump ups [from Congress] just because times are hard,” Yocom says. The report says that “once a threshold number of states — 26 in GAO’s prototype formula — show a sustained decrease in their employment to-population (EPOP) ratio, temporary increases to states’ FMAPs would be triggered automatically.”

The report details how GAO’s formula would have played out. With the stimulus funds, more federal dollars flowed to the states from October 2008 through June 2011 – a total of 13 fiscal quarters. With the new formula, the assistance would have started in Janaury 2008 and gone through September 2011 – more in sync with the states’ economic distress – for a total of 15 quarters, an extra 6 months.

Put another way: the recession ran from December 2007 to June 2009. As the effects rippled down, people lost jobs and health insurance, the states were squeezed later and for longer than the actual recession.

Joy Johnson Wilson, the health policy director of the National Conference of State Legislatures (NCSL), says with the health law’s expansion of Medicaid in 2014, it is critical to reassess how federal dollars are matched to states. She points out that there are no provisions in the new health care law to protect state Medicaid budgets against recessions. “Under the Affordable Care Act [states] are now responsible for a substantial expansion of an entitlement program,” she says. “[Medicaid] is an entitlement program, so we have to provide that care. While [states] are struggling now to do that, in 2014, it’ll be a whole other set of people coming onto the program, so I think it makes it much more important that there is some protection for state budgets.”