Latest KFF Health News Stories

La inflación médica ha superado de manera constante la inflación general durante años, y las facturas de muchos procedimientos breves y de rutina llegan a decenas de miles de dólares.

Even Patients Are Shocked by the Prices Their Insurers Will Pay — And It Costs All of Us

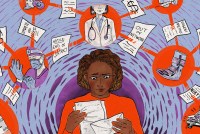

Health care prices are on the rise, and patients are flummoxed that even insurance companies aren’t doing more to control costs.

They Need a Ventilator To Stay Alive. Getting One Can Be a Nightmare.

Few nursing homes are set up to care for people needing help breathing with a ventilator because of ALS or other infirmities. Insurers often resist paying for ventilators at home, and innovative programs are now endangered by Medicaid cuts.

An Arm and a Leg: This Health Economist Wants Your Medical Bills

A longtime health economist sets her sights on lowering Americans’ insurance premiums.

Qué ocurre cuando tus médicos ya no están en la red de tu aseguradora

En todo el país, las disputas contractuales son comunes, con más de 650 hospitales involucrados en conflictos públicos con aseguradoras desde 2021.

So Your Insurance Dropped Your Doctor. Now What?

Patients sometimes find themselves scrambling for affordable care when a contract dispute causes a hospital — and most of the doctors and other clinicians who work there — to be dropped from an insurance network. Here are six things to know if that happens to you.

As Insurers Struggle With GLP-1 Drug Costs, Some Seek To Wean Patients Off

Conventional wisdom says GLP-1 drugs must be taken indefinitely to maintain weight loss. But a growing number of researchers, payers, and providers are challenging that consensus and exploring whether — and how — to taper patients off expensive GLP-1 drugs.

Cuando los pacientes quedan atrapados en medio de las peleas entre aseguradoras y hospitales

El 18% de los hospitales no federales experimentaron al menos un caso documentado de enfrentamiento público con una aseguradora entre junio de 2021 y mayo de 2025. Lo sufren los pacientes.

When Hospitals and Insurers Fight, Patients Get Caught in the Middle

About 90,000 people spent months in limbo as central Missouri’s major, and often only, provider fought over insurance contracts. Patients getting caught in the crossfire of disputes has become a familiar complication, as about 8% of hospitals have left an insurer network since 2021. Trump administration policies could accelerate the trend.

Insurers and Customers Brace for Double Whammy to Obamacare Premiums

Consumers face both rising premiums and falling subsidies next year in Obamacare plans, with insurers seeking increases to cover not only rising costs but also some policy changes advanced by President Donald Trump and the GOP.

5 Takeaways From Health Insurers’ New Pledge To Improve Prior Authorization

Dozens of health insurance companies pledged on Monday to improve prior authorization, a process often used to deny care. The announcement comes months after the killing of UnitedHealthcare executive Brian Thompson, whose death in December sparked widespread criticism about insurance denials.

Their Physical Therapy Coverage Ran Out Before They Could Walk Again

Health plans limit physical or occupational therapy sessions to as few as 20 a year, no matter the patient’s infirmities. The limits persist despite federal rules banning insurers from setting annual dollar limits on the care they will provide.

Federal Watchdog Urges Crackdown on Medicare Advantage Home Visits

Medicare officials are pushing back against a federal watchdog’s call to crack down on home visits by Medicare Advantage health plans — a practice the watchdog says may waste billions of tax dollars every year. In late October, a Health and Human Services inspector general audit found that the insurers pocketed $7.5 billion in 2023 from diagnosing health conditions that […]

The Medicare Advantage Influence Machine

New court filings and lobbying reports reveal an industry drive to tamp down critics — and retain billions of dollars in overcharges.

Cuando tu cobertura de salud dentro de la red… simplemente se esfuma

los contratos de las aseguradoras con médicos, hospitales y farmacéuticas (o sus intermediarios, los llamados administradores de beneficios farmacéuticos) pueden cambiar abruptamente de la noche a la mañana.

How Your In-Network Health Coverage Can Vanish Before You Know It

One of the most unfair aspects of medical insurance is this: Patients can change insurance only during end-of-year enrollment periods or at the time of “qualifying life events.” But insurers’ contracts with doctors, hospitals, and pharmaceutical companies can change abruptly at any time.

The Colonoscopies Were Free. But the ‘Surgical Trays’ Came With $600 Price Tags.

Health providers may bill however they choose — including in ways that could leave patients with unexpected bills for “free” care. Routine preventive care saddled an Illinois couple with his-and-her bills for “surgical trays.”

When a Quick Telehealth Visit Yields Multiple Surprises Beyond a Big Bill

For the patient, it was a quick and inexpensive virtual appointment. Why it cost 10 times what she expected became a mystery.

Out for Blood? For Routine Lab Work, the Hospital Billed Her $2,400

Convenient as it may be, beware of getting your blood drawn at a hospital. The cost could be much higher than at an independent lab, and your insurance might not cover it all.

Quick Genetic Test Offers Hope for Sick, Undiagnosed Kids. But Few Insurers Offer to Pay.

A new, rapid genetic test shows promise in increasing diagnoses and improving treatment for some children with rare genetic conditions. Many insurers won’t cover it, but Florida’s Medicaid program is among those that see benefits — and, potentially, savings.