Latest KFF Health News Stories

For Some Families, Coverage With Separate Deductibles Might Be The Best Choice

Smart shoppers will dig deep to find out if their family coverage has one deductible for the whole family or separate “embedded” deductibles for each family member. The answer could make a big difference in your out-of-pocket costs.

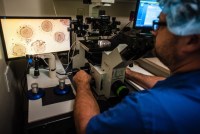

Few Women Have Coverage For Egg Freezing

Although egg freezing is the perk du jour at some high profile companies, too often such options are not available, even for women with serious illnesses such as cancer.

Many Obamacare Plans Set Out-Of-Pocket Spending Limits Below The Cap

This news analysis examines why consumers should look at more than premiums when shopping for policies.

Consumers May Miss Out On Subsidies Due To Uncertainty About Job-Based Coverage

Some people don’t know whether their job-based coverage disqualifies them from federal subsidies to buy policies in online insurance marketplaces.

Switching To A Spouse’s Plan Can Be Difficult If Timing Isn’t Right

If a couple wants to transfer health insurance policies, it is often pretty easy because most companies use a calendar-year coverage period. But if one company’s enrollment is on a different schedule, switching can be problematic.

EEOC Takes Aim At Wellness Programs Increasingly Offered By Employers

The lawsuits brought by the commission, which have raised complaints from business leaders, highlight the lack of clarity in the standards under the Americans with Disabilities Act.

Turning 21? Here’s How To Avoid A Big Hike In Health Insurance Premiums

Coming of age can also mean a whopping 58 percent jump in the cost of your insurance.

Marketplaces Will Automatically Renew Consumers’ Plans, But Take A Look First

KHN’s consumer columnist answers questions about enrollment under the health law and cautions people not to just go with last year’s choice.

Laws Spreading That Allow Terminal Patients Access To Experimental Drugs

Five states have approved the measures this year, but critics note that they don’t address the issues of patient costs and don’t mean the drug makers will necessarily make the medications available.

With Tight Enrollment Window, Consumers Seeking Coverage Should Sign Up Promptly

The online marketplaces open Saturday and officials say they will work better than at last year’s debut.

Pay Close Attention To The Enrollment Calendar To Avoid Penalties

Consumers can sign up on the health insurance marketplace from Nov. 15 to Feb. 15 but waiting can leave them exposed to not only medical bills but also the health law’s penalties.

Rate Of Premature Births Fall As Health Law Provisions Begin To Take Effect

March of Dimes official says one key factor was early implementation of the Medicaid expansion in some states.

Lack Of Understanding About Insurance Could Lead To Poor Choices

A recent poll points out that while three-quarters of Americans say they are confident about understanding their health coverage options, only 20 percent could calculate what they owed for a routine doctor’s appointment.

Hepatitis C Patients May Not Qualify For Pricey Drugs Unless Illness Is Advanced

Many insurers are restricting access to new drugs that promise higher cure rates because the price tags can run $95,000 or more.

Forget Ebola And Get A Free Flu Shot

Under the health law, insurers cover the immunizations with no out-of-pocket costs to consumers.

More Plans Setting Spending Limits For Some Medical Services

Insurers cap how much they will pay for certain routine procedures, such as knee replacements and lab tests, and if patients opt for an in-network facility that charges more, they must pick up the extra cost.

Consumers Whose Income Drops Below Poverty Get Break On Subsidy Payback

People who suffered a drop in earnings and fall below the poverty line don’t have to repay subsidies, but others who underestimated their income could be in for a surprise at tax time.

Modest Premium Hikes, Higher Consumer Costs Likely For Job-Based Plans

As many companies provide employees with their coverage details this fall, spousal surcharges and health savings accounts on the rise.

Long-Acting Contraceptives Still Often Not Free For Women

The health law called for all FDA-approved birth control methods to be completely covered by insurance, but research suggests that many women still pay for some of the costs for options such as IUDs and injectable contraceptives.

How Will Taxes Be Reconciled With Premium Subsidies?

KHN consumer columnist Michelle Andrews examines how subsidies for health insurance can be divvied up among family members choosing separate plans and how a miscalculation of the premium will be handled on your taxes.