Latest KFF Health News Stories

Check The Fine Print: Some Work-Based Health Plans Exclude Outpatient Surgeries

This new generation of so-called “skinny plans” can save employers money, but it’s not yet clear if they will meet regulatory scrutiny.

New Federal Standards For Marketplace Plans May Reduce Out-Of-Pocket Spending

Officials have proposed establishing six options for the exchange plans that would set standard deductibles and maximum out-of-pocket spending limits, among other things.

Determining Whether A Marketplace Plan Covers Abortion Is Still Difficult

Many insurers leave out information about abortion coverage on the summary of benefits and coverage.

Hispanic Children’s Uninsured Rate Hits Record Low, Study Finds

About 300,000 Hispanic children gained insurance in 2014 from 2013, dropping the number of uninsured to 1.7 million, researchers said, and two-thirds of 1.7 million uninsured Hispanic kids live in five states.

Study: Some Marketplace Customers Spend 25 Percent Of Income On Health Expenses

Urban Institute researchers found that premiums and out-of-pocket costs are still a major concern for people seeking coverage on the health care marketplaces.

Obama Seeks To Offer New Incentive For States To Expand Medicaid

The White House would like to extend full federal funding for three years to states that now opt to expand Medicaid, but Congress would have to approve any change.

Slipping Between Medicaid And Marketplace Coverage Can Leave Consumers Confused

KHN’s consumer columnist answers questions about how people can handle moving between the government health plan for low-income residents and the private plans offered on the federal health law’s exchanges.

Health Plan Watchdog Still Seeks Progress After 25 Years

Increased comparative information on health plans is helping consumers shop, says Margaret O’Kane, president of the National Committee for Quality Assurance.

2016 Health Law Exchange Enrollment Tops 11.3M

The government’s most detailed release of figures shows insurance plan sign-ups beat the Obama administration’s goal for the year.

Turning To Medicaid To Insure Lowest-Paid Employees

A startup company called BeneStream helps businesses get their low-wage workers on Medicaid to meet the health law’s mandate for employers.

More Employers Offer Plans That Provide Lump Sums For Critical Illnesses

The plans can help workers cover their high deductibles, but the policies also have limitations.

Obamacare Insurers Sweeten Plans With Free Doctor Visits

Some insurers are betting that lowering the barrier to seeing a doctor will encourage people to get needed care sooner. If it works, the health plans could save more than they spend on the benefit.

Medicare Payment Changes Lead More Men To Get Screening Colonoscopies

The health law waived Medicare’s Part B deductible and dropped the 20 percent copayment for the preventive tests.

Despite Hopes Of Health Law Advocates, ‘Multi-State’ Health Plans Unavailable In Many States

The authors of the law mandated the program to try to generate more competition in areas where few plans were available. But the effort has stalled.

Last Chances Approach To Sign Up For 2016 Obamacare Coverage

With a two-day extension, December 17th is now the last chance to sign up for Obamacare health insurance coverage that starts Jan. 1 through the federal exchange. Open enrollment for the plans continues through the end of January, however.

California Exchange Targets ‘Hot Spots’ With High Rates Of Uninsured

Tuesday is the deadline to sign up for health coverage that begins in January, so Covered California is boosting enrollment efforts in certain underserved communities.

State Obamacare Exchanges ‘Sustainable’ Without Federal Aid, Official Tells Congress

But CMS Acting Administrator Andy Slavitt declines to predict fate of the 13 remaining state exchanges in congressional testimony.

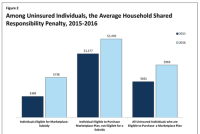

Uninsured People Eligible For Obamacare Face Average $969 Penalty In 2016

Average penalties are set to rise 47 percent next year for Americans who can afford insurance but choose to remain uncovered, according to a Kaiser Family Foundation analysis.

Cigna CEO David Cordani: ACA Marketplace Is Still In ‘Version 1.0’

In a recent interview, Cordani discussed the evolution of exchange health plans as well the proposed merger between Cigna and Anthem.

Kentucky Strategy Will Test Need For State-Run Obamacare Exchanges

Experts say Gov.-elect Matt Bevin’s plan to drop Kynect and use the federal healthcare.gov marketplace would have little impact on consumers, if it happens.