Latest KFF Health News Stories

When Medicare Advantage Drops Doctors, Some Members Can Switch Plans

In the past eight months, Medicare officials have quietly granted the special enrollment periods to more than 15,000 Medicare Advantage members in seven states, the District of Columbia and Puerto Rico.

Supreme Court Takes Up Birth Control Access — Again

Justices consider a key aspect of the Affordable Care Act for the fourth time in five years.

California Insurance Marketplace Wants To Kick Out Poor-Performing Hospitals

Providers and insurers are balking at a Covered California proposal to eject hospitals with inordinately high costs and low quality from its networks.

Long-Term Care Insurance: Less Bang, More Buck

Seniors slammed with big premium increases face tough choices.

Three Changes Consumers Can Expect In Next Year’s Obamacare Coverage

The Department of Health and Human Services issues new rules designed to simplify health coverage consumers buy through Healthcare.gov.

Cigna Profits As Medicare Softens Penalty Policy

A new policy preserves Cigna’s access to bonuses while the insurer fixes “widespread” failures in its Medicare plans.

FAQ: What Are The Penalties For Not Getting Insurance?

A consumer’s guide to the tax penalties for not having insurance.

N.H., Calif. Seek To Help Consumers Get Details On Health Care Prices

New Hampshire is expanding its website that lists the cost of specific medical procedures to include dental treatments and 65 prescription drugs. California is expanding its report cards on large medical groups to include cost of medical services by an average patient.

TrumpCare Takes It On The Chin

GOP health policy analysts skewer front-runner’s health proposal.

Consumer Choices Have Limited Impact On U.S. Health Care Spending: Study

An analysis from the Health Care Cost Institute finds that less than half of health care costs are for services considered “shoppable,” and consumers’ out-of-pocket spending on that is just 7 percent of all spending.

Aetna CEO Answers Burwell’s Call, Vows Support For Exchanges Amid Losses

But Mark Bertolini wants the country’s marketplaces to better serve young people, who define

healthy as “looking good in their underwear.”

Will Healthcare.gov Get A California Makeover?

Feds propose taking a page out of Covered California’s book and moving to a simplified health insurance marketplace.

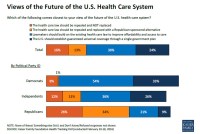

Support For Sanders’ Single-Payer Plan Fades With Control, Cost Concerns

Although half of Americans favor the idea of a government health insurance system, the popularity drops significantly when negative arguments are presented, poll finds.

Supreme Court Vacancy Creates Muddle For Future Of Reproductive Rights

Scalia’s death throws cases on abortion, contraception coverage into doubt.

California Marketplace May Require Insurers To Pay Agent Commissions

Covered California’s Executive Director Peter Lee said the measure is needed to keep insurers from slicing commissions to avoid enrolling the sickest patients.

Delay Of New Health Law Forms May Confuse Some Taxpayers

Employers, insurers and government health programs such as Medicare and Medicaid are required to send taxpayers a form showing whether they provided health care but the government has pushed back the deadline for the forms.

Top Hospitals Likely Are Available On A Marketplace Plan, Study Finds

Many of the hospitals can be found in network on at least one plan, but fewer are participating in more than that, according to the analysis.

Blue Shield Top Choice On California Exchange

Anthem sign-ups are trailing, and UnitedHealth and newcomer Oscar are playing a minor role in coverage thus far, according to unofficial reports.

A 401(k) Withdrawal Can Lead To Trouble For Health Plan Subsidies

The retirement savings are considered income, so an unexpected withdrawal may change the level of premium subsidies for which an individual qualifies.

Narrow Marketplace Plans In Texas Pose Problems For Autistic Children

The move away from policies that allow families to seek out-of-network care is forcing many parents with autistic children to consider covering therapy costs themselves.